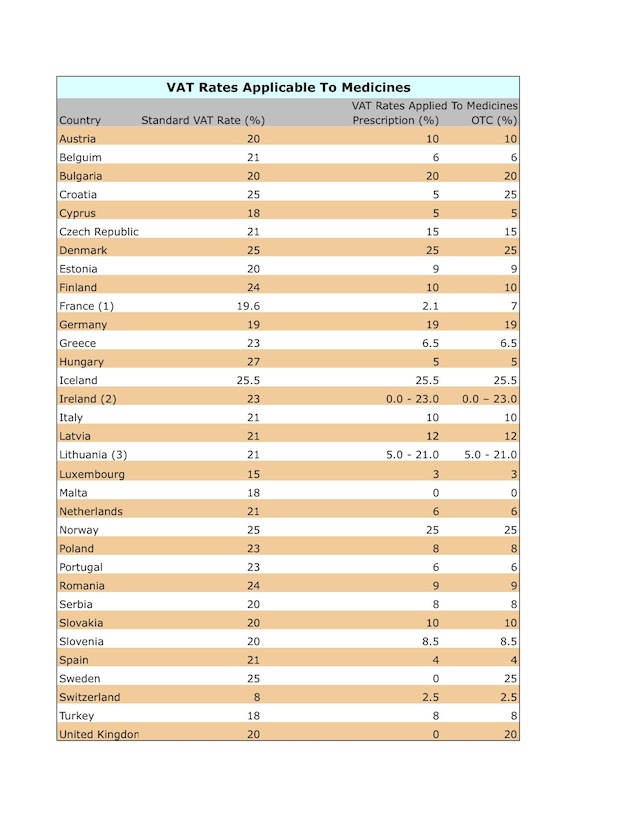

This table shows the VAT rates applied to medicines in European countries as of 1 January 2013.

(1) France: reimbursable medicines 2.1%; non-reimbursable medicines 7.0%

(2) Ireland: oral medication 0%; other medication 23.0%

(3) Lithuania: reimbursable medicines 5.0%; non-reimbursable medicines 21.0%

Source: Tax data from each country

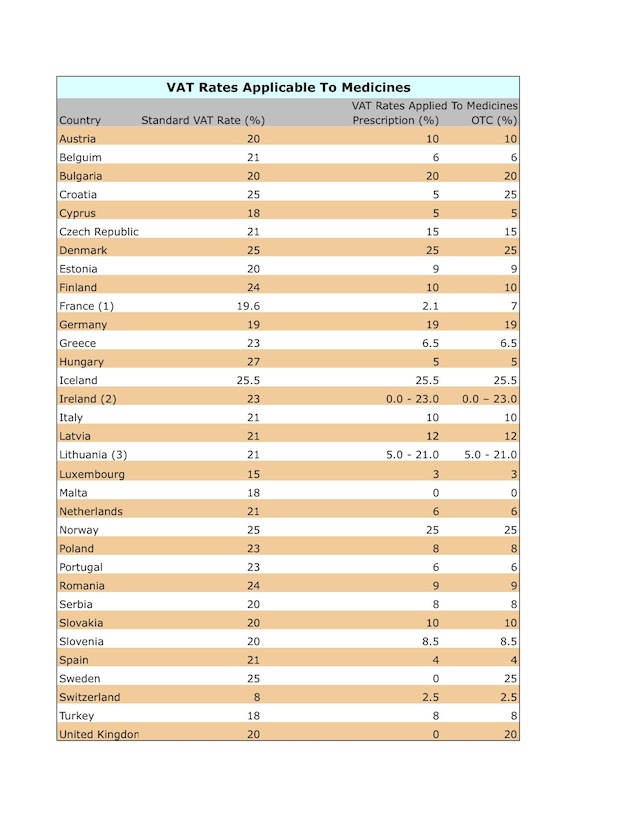

(1) France: reimbursable medicines 2.1%; non-reimbursable medicines 7.0%

(2) Ireland: oral medication 0%; other medication 23.0%

(3) Lithuania: reimbursable medicines 5.0%; non-reimbursable medicines 21.0%

Source: Tax data from each country

(1) France: reimbursable medicines 2.1%; non-reimbursable medicines 7.0%

(2) Ireland: oral medication 0%; other medication 23.0%

(3) Lithuania: reimbursable medicines 5.0%; non-reimbursable medicines 21.0%

Source: Tax data from each country

(1) France: reimbursable medicines 2.1%; non-reimbursable medicines 7.0%

(2) Ireland: oral medication 0%; other medication 23.0%

(3) Lithuania: reimbursable medicines 5.0%; non-reimbursable medicines 21.0%

Source: Tax data from each country