Market Access & Health Technology Assesment: Spain

Market Access & Health Technology Assesment: Spain is a must-have asset for any company operating in Spain or looking to enter the market.

Prepared in association with Faus & Moliner Abogados, a leading Spanish law firm.

October 2023

1. Healthcare System and Funding: Spain

1. Please make a general introduction to the public health sector in your country and its organization

The National Health System (“NHS”) is based on the principles of universal coverage and solidarity. Art. 43 of the Spanish Constitution establishes the right to healthcare as one of the basic principles that must inspire action by all public administrations, and this has been interpreted to recognise universal access to healthcare. The NHS is mainly funded from taxes.

Spain has a decentralized political system, with a central government and 17 regions, so-called Autonomous Communities. This has a relevant impact on the organization of the NHS because many healthcare competences have been transferred to the Autonomous Communities.

The central government is responsible for establishing the bases and general coordination of healthcare throughout the state, as well as for establishing legislation on pharmaceutical products. The Interterritorial Council of the National Health System (“CISNS”), which comprises the national health minister and the 17 regional ministers of health of each Autonomous Community (except for the two Autonomous Cities of Ceuta and Melilla), is responsible for high-level coordination of actions across the regional health system.

The central government, through the Ministry of Health, is also responsible for approving pricing and reimbursement of medicinal products. However, since the public funds that may be used to finance such reimbursement come out the budget of the 17 Autonomous Communities, such Autonomous Communities participate in the committee of the Ministry of Health (Inter-Ministerial Commission of Prices of Medicinal Products) responsible for assessing applications for price and reimbursement of medicinal products.

Regional governments, for their part, have broad powers on health matters, including the provision of public healthcare services and related funding.

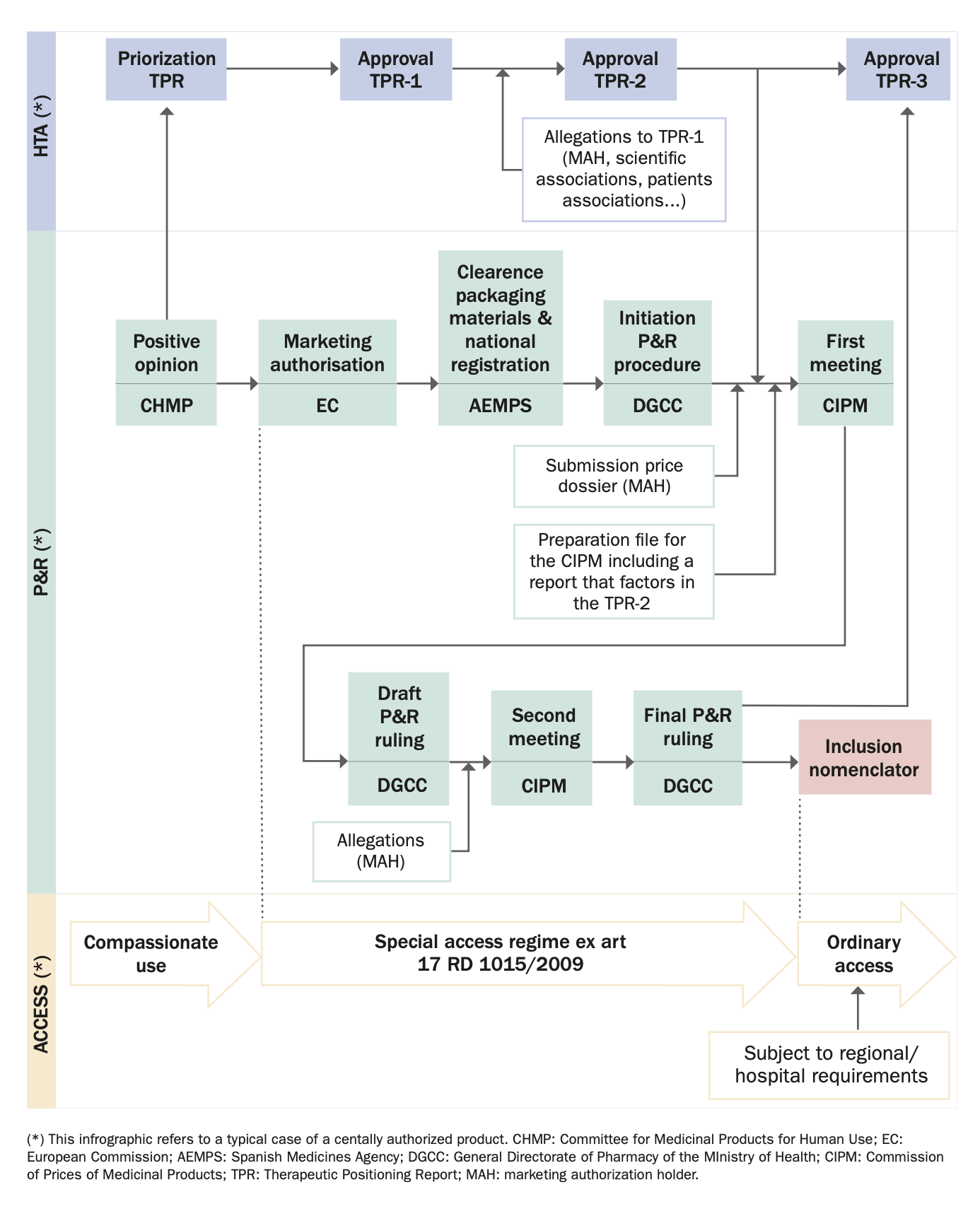

2. Please provide any infographics including, the actors involved in the market access process (market authorization, pricing decisions, reimbursement decisions); and the process and flow.

Also from this Market Access & Health Technology Assessment

2. Healthcare Actors and Payers: Spain

1. Which are the administrations, bodies and institutions in charge of public health in your country and what are their respective responsibilities?

The main administrations in charge of public health and reimbursement of medicinal products in Spain are: the Spanish Agency of Medicines and Medical Devices (“AEMPS”), the Ministry of Health (“MOH”), particularly the General Directorate of Pharmacy (“DGCC”), the Inter-Ministerial Commission of Prices of Medicinal Products (“CIPM”), the Advisory Committee for the Pharmaceutical Provision of the NHS, REVALMED (which is a net of different bodies in charge of HTA as we will discussed below)[1], and the health departments of the regional governments.

We will discuss the role of each of such bodies in the following questions.

2. Which are the administrations, bodies and institutions in charge of drug approvals in your country and what are their respective responsibilities?

The AEMPS is responsible for the evaluation and, where appropriate, authorization of medicinal products by national, decentralized (“DCP”) or mutual recognition procedures (“MRP”). Its legal regime and functions are contemplated in Royal Decree 1275/2011 which created the AEMPS and approved its Statute.

In addition, the AEMPS plays an important role in the process of preparing the Therapeutic Positioning Report (“TPR”) to which we will refer below.

3. Which are the administrations, bodies and institutions in charge of Health Technology Assessment in your countries and what are their respective responsibilities?

There is some confusion in Spain on this issue; especially after the recent Judgement of 26 June 2023 by the Spanish National High Court that has annulled the Plan to consolidate TPRs that the MOH had approved to regulate the preparation of TPRs (the main HTA instrument in Spain for medicinal products). The European HTA Regulation also adds uncertainty to this scenario insofar as it is still unclear how the evaluation reports foreseen therein will affect Spanish TPRs.

Be it as it may, as things stand, the main bodies in charge of HTA in Spain are the AEMPS, the MOH and the regional governments; all of such bodies acting in coordination through REVALMED. This statement, however, needs to be qualified and contextualized. We do so below.

First, the main HTA instrument for medicinal products in Spain is the TPR. TPRs were created in 2013 with the objective “to provide, beyond the authorization of the medicinal product, relevant information, based on scientific evidence of the position that the new product occupies in the market in comparison with other drugs or health measures already in existence”[2]. The legal basis for such TPRs is Third Additional Provision of Law 10/2013 which establishes that the position of a medicinal product in the pharmaceutical provision and its comparison with other therapeutic alternatives will be carried out through TPRs, which are binding, and have to be elaborated and approved by the AEMPS, having a common scientific-technical basis for the entire NHS.

Second, notwithstanding what is said in Law 10/2023, in 2020 it was approved the so called “Plan to Consolidate TPRs”, which created REVALMED[3], a network under which other agencies, in addition to the AEMPS, have a relevant role in the preparation and approval of the TPRs. REVALMED has been responsible for the coordination of the TPR process in Spain since 2020, and is composed of:

- Therapeutic Evaluation Group. Its function is to prepare the first draft of the TPR with regard to the therapeutic sections. It is led by the AEMPS, although it also includes members of the DGCC.

- Pharmaco-Economic Evaluation Group. Its function is to prepare the first draft of the TPR with regard to pharmacoeconomic aspects. It is led by the DGCC, although it can also include members appointed by the Autonomous Communities.

- Evaluation Nodes. Their function is to review the draft of the TPR and make contributions. They are made up of expert management and clinical professionals appointed by the Autonomous Communities.

- Coordinating Group. Its function is to identify the TPRs to be developed, prioritize them (according to certain pre-defined criteria) and, finally, approve them. It is made up of members of the DGCC, the AEMPS, coordinators of the Evaluation Nodes and representatives of the Autonomous Communities.

Third, since approval of the Plan to Consolidate TPRs in 2020, some TPRs also include pharmaco-economic evaluation assessments. This inclusion has created some tension and discrepancies among relevant stakeholders who question whether TPRs are the appropriate instrument for incorporating this type of evaluation.

Fourth, Farmaindustria (the National Trade Association of the Spanish based pharmaceutical industry) appealed the Plan to Consolidate TPRs. The legal basis of the appeal was based on two arguments. First, the Plan to Consolidate TPRs is in the nature of a general provision. It is not a mere internal organizational instrument, as the MOH defended. This being so, Farmaindustria requested the nullity of the Plan as it was approved by a manifestly incompetent body (the Committee on Pharmacy of the CISNS) with absolute omission of the legally established procedure. Second, the Plan to Consolidate TPRs must be annulled because it is contrary to the principle of hierarchy of norms. The Plan to Consolidate TPRs provides that TPRs will have a “scientific and economic basis”, and that they will be approved by the REVALMED Coordination Group. However, Law 10/2013, the only legal basis for the TPRs, provides that TPRs “shall have a scientific basis” (without any mention of the economic issue) and must be approved by the AEMPS.

The Spanish National High Court upheld the appeal in its entirety. The Judgement (as per the information available at the time of publication) was not appealed.

As stated above, the impact of this Judgement to the Spanish HTA process is still unclear but it is likely that it will imply profound changes in that process over the coming months. Close follow-up of the topic will be necessary.

4. Which are the administrations, bodies and institutions that qualify as “payers” in your country and what are their respective responsibilities?

Spain’s regional governments pay for all healthcare services from their own budgets. They enjoy a large degree of autonomy to decide how they purchase the goods and services they may require to provide healthcare services to patients.

The MOH is the department of the central government responsible for approving the reimbursement of medicinal products. As explained, the public funds that may be used to finance this reimbursement come out of the budgets of the 17 Autonomous Communities into which Spain is divided. Because of this, the Autonomous Communities participate in the CIPM, the specific committee within the MOH responsible for assessing applications and deciding on the maximum ex-factory price (so called “PVL”, which stands for “Precio Venta Laboratorio”) for reimbursed medicinal products.

This generates a complex situation where the basic content of the pharmaceutical provision is set forth at the state level (because the MOH makes the decision on pricing and reimbursement, as explained below) but regional governments are responsible for financing it out of their budgets.

5. Which are the administrations, bodies and institutions in charge of reimbursement decisions in your countries and what are their respective responsibilities?

The MOH, particularly the DGCC, is the department of the central Spanish government in charge of pricing decisions of medicinal products. The DGCC’s functions are contemplated in Royal Decree 735/2020. Such functions include deciding on whether a medicinal product shall be reimbursed or not by the NHS and providing technical and administrative support to the CIPM.

The CIPM is a collegiate body formed by representatives of the MOH, the Ministry of Economic Affairs and Digital Transformation, the Ministry of Treasury and representatives of the Autonomous Communities. The CIPM is responsible for deciding on the maximum ex-factory price for reimbursed medicinal products (PVL). Its specific legal regime is contemplated in Law on Rationale Use of Medicines and Medical Devices (Royal Legislative Decree 1/2015) and in Law on Legal Regime of the Public Sector (Law 40/2015).

The MOH, through the DGCC, and the CIPM, decide on reimbursement and then on price. In theory, the DGCC is the first to decide whether the product is reimbursed, and the CIPM then decides on the maximum reimbursed price. In practice, however, the two procedures run in parallel and overlap because the decision of the DGCC regarding reimbursement is also based on the price that the CIPM would set for the product. The DGCC, on the other hand, takes care of process management, preparing the rulings that the CIPM shall adopt. It is also the de facto leader of the negotiations with the Marketing Authorization Holder (“MAH”) and coordinates the work carried out by evaluation groups who handle the dossiers prior to the meeting of the CIPM.

6. Which are the administrations, bodies and institutions in charge of reimbursement decisions in your countries and what are their respective responsibilities?

See Q5 (Section II).

7. Which are the administrations, bodies and institutions in charge of public procurement and tendering in your country and what are their respective responsibilities?

Regional governments and public hospitals are in charge of public procurement and tendering in Spain. See Section IX below.

8. What are the other actors of significance with regards to market access in your country and what are their respective responsibilities?

The Autonomous Communities play a large role in market access. This is because even though the MOH decides which therapies are financed, the Autonomous Communities allocate the budget for financing such therapies. This means that in the case of high budgetary-impact products, companies may expect access to the market to be subject to agreements with regional authorities (or sometimes with local hospitals) regarding the conditions under which the product will be available in such a region or hospital.

The role of the Autonomous Communities become even more relevant for non-reimbursed products, that is products that the MOH has decided not to reimburse. The purchase of such products by the Autonomous Communities is subject to the approval of the relevant Therapeutic Commission of each Autonomous Community. Such Commission may decide whether such non-reimbursed product may be purchased by hospitals of the Autonomous Community or not.

[1] REVALMED has been recently questioned by a Court Judgement as we indicate in different sections of this publication.

[2] Collaboration proposal for the elaboration of Therapeutic Positioning Reports of medicinal products, accessible at: https://www.aemps.gob.es/medicamentosUsoHumano/informesPublicos/docs/propuesta-colaboracion-informes-posicionamiento-terapeutico.pdf.

[3] Plan to consolidate the Therapeutic Positioning Report in the National Health System, accessible here: https://www.sanidad.gob.es/profesionales/farmacia/IPT/docs/20200708.Plan_de_accion_para_la_consolidacion_de_los_IPT.actCPF8Julio.pdf.

Also from this Market Access & Health Technology Assessment

3. Post Market-Approval Processes and Regulations: Spain

1. What are the pricing models, processes and principles for originator drugs?

Originator medicinal products must go through price and reimbursement proceedings (P&R Procedure) where it is decided if they are to be reimbursed or not. If reimbursed, the PVL is also fixed.

To determine whether a medicinal product is reimbursed or not, the DGCC/CIPM must take into account the following criteria (art. 92 and 94 of Royal Legislative Decree 1/2015):

- the seriousness, duration and sequels of the pathologies for which the product is approved;

- the needs of special groups of people;

- the therapeutic and social utility of the product as well as its incremental clinical benefit, taking into account its cost and effectiveness;

- the need to limit and rationalise public pharmaceutical expenditure and the impact of the medicinal product on the NHS;

- the existence of medicines already available and the existence of other alternatives for the same illnesses, which have a lower price;

- budget impact and cost-effective analysis;

- The contribution of the product to Spain’s gross domestic product;

- the degree of innovation of the product: whether it provides an indisputable therapeutic advance for altering the course of an illness or easing the course of such illness; and its results or contribution to the NHS;

- The return mechanisms that may be proposed by the MAH (discounts, price reviews). This is the result of the increasing relevance that risk-sharing schemes are currently having in Spanish practice; many companies, especially for high-budgetary-impact products, are required to offer specific arrangements to obtain reimbursement.

From a procedural standpoint, the typical P&R Procedure (there may be particularities/changes on a case-by-case basis) incorporates the following phases: (i) initiation: the P&R Proceeding starts ex-officio; the DGCC shall send a letter to the MAH or to its local representative (“LR”), informing it that the process has begun and granting the MAH a period between 10 and 15 working days to make any submission it deems convenient on the reimbursement of the product, (ii) negotiation between the MAH/LR and the DGCC, and preparation by the DGCC of a report for the CIPM in which the DGCC performs a therapeutic (and sometimes economic) evaluation of the new drug/new indication (this report is commonly referred to as the “Associate Report for the CIPM” or “Associate Report”), (iii) evaluation of the new medicinal product/new indication by the CIPM, (iv) issuance by the DGCC of a draft resolution on the reimbursement/non reimbursement of the new medicinal product/new indication as resolved by the CIPM, (iv) submission of allegations by the MAH/LR (if any), (v) assessment of the allegations by the CIPM/DGCC (if any) and (vi) final ruling of the DGCC.

Under the law, the whole P&R Proceeding may take up to 180 days. However, authorities usually request additional information, and these requests may stop the clock on the procedure. In practice, companies may well expect the reimbursement approval to run for a minimum of six months. Occasionally, procedures have taken longer.

2. What are the pricing models, processes and principles for generics and biosimilars drugs?

Theoretically, generics and biosimilar drugs must go through the same P&R Procedure explained in Q1 (Section III) above. However, in practice, what usually happens is that such products go through a sort of “simplified” P&R Procedure which, in essence, means that generics/biosimilar products are reimbursed with an approximate 40% (generics) or 20-30% (biosimilars) discount with respect the originator.

3. What are the reimbursement approval processes and principles for originator drugs?

Please refer to Q1 (Section III) above.

4. What are the reimbursement approval processes and principles for generics and biosimilar drugs?

Please refer to Q2 (Section III) above.

5. Are there any other special processes to be considered for certain types of drugs?

Non-industrially manufactured advanced therapy medicinal products (“ATMPs”) are subject to a special P&R Procedure.

In October 2019, the CISNS issued an agreement on the general conditions for planning, coordination, contracting, procurement and supply of ATMPs for the publicly owned structures and services integrated in the NHS (the “2019 Agreement”).

In the 2019 Agreement, the CISNS confirmed that for the reimbursement of medicinal products, their inclusion in the pharmaceutical provision of the NHS is necessary because this is contemplated in art. 92.1 of Royal Legislative Decree 1/2015. However, in contrast to industrially manufactured medicinal products where the DGCC and CIPM are competent (see Q5 Section II), the 2019 Agreement determined that CISNS is the competent body to decide on the reimbursement of non-industrially manufactured ATMPs.

The 2019 Agreement was based on the opinion of the State Attorney who relied on art. 91.6 of Royal Legislative Decree 1/2015 that expressly states that “[T]he Interterritorial Council of the National Health System may agree on the general conditions for planning, coordination, contracting, procurement and supply of medicines and medical devices of the publicly owned structures and services integrated in the National Health System”.

Also from this Market Access & Health Technology Assessment

4. Price Control and Reference Pricing Systems: Spain

1. Price Control

1. How does price control at ex-factory prices work in your country?

This question may be broken down in two parts: (i) situations in which a medicinal product may be in connection with its reimbursement status/price; and (ii) criteria to determine PVL.

Situations in which a medicinal product may be in connection with its reimbursement status/price:

- Medicinal products that have been granted a MA but for which a reimbursement/price ruling has not been issued.

They may be available in Spain ex art. 17 in fine of Royal Decree 1015/2009 regulating the availability of medicines in special situations. Their use must be authorized by the AEMPS, either for an individual patient or for a specific subpopulation of patients (protocol for use).

Their price is free (not regulated), and it is set by the supplier, usually after negotiation with the hospital pharmacy service. It is not uncommon for hospitals to pressure the company to supply the product free of charge, especially for those patients who were being treated with the medicinal product in the context of a clinical trial. The company has no legal obligation to supply the product free of charge except if the company obtains some information from the administration of the medicinal product (art. 31 and 39.1.f of Royal Decree 1090/2015).

- Medicinal products that have been granted a MA and for which a reimbursement/price ruling has already been issued.

Their commercialization is carried out at the following maximum prices.

For units dispensed in Spain at the expense of the NHS, the maximum reimbursement price is the PVL set by the CIPM.

For units dispensed outside the NHS (that is not reimbursed units), the maximum price at which they can be marketed is the “notified price”. The notified price is free although the DGCC can object to it for reasons of public interest ex art. 94.4 of Royal Legislative Decree 1/2015. Since there is no specific term for the DGCC to express this objection, we understand that the general term of 3 months applies.

- Medicinal products that have a MA and an express non-reimbursement ruling of the DGCC.

According to a Report issued by the DGCC in 2019, the managing entities of the NHS and/or public hospitals cannot acquire medicinal products in this situation. In our opinion, this conclusion of the Report has no legal support and, therefore, lacks any legal validity. Among other issues, the DGCC has no authority to issue such a report. Moreover, there is no regulation that prohibits public hospitals from acquiring these medicinal products; in fact, this possibility is specifically contemplated in Royal Decree 1718/2010 on medical prescriptions and dispensing orders. Be that as it may, the reality is that in practice some Autonomous Communities follow the criteria of the Report and do not purchase medicinal products with an express non-reimbursement ruling.

In our opinion, medicinal products with an express non-reimbursement ruling of the DGCC can be marketed outside the NHS at free price.

- Medicinal products that have a MA but have never been reimbursed and have never been the object of an express non-reimbursement ruling of the DGCC.

They can be marketed at free price.

- Medicinal products that had been reimbursed but have been subsequently excluded from reimbursement.

They can be marketed at free price. However, this price must be communicated to the MOH so that, within a period of one month, it can decide on its conformity (art. 93.3 of Royal Legislative Decree 1/2015). In case of disagreement, the file is submitted to the CIPM, which must decide on the basis of “reasons of protection of public health, equal access to medicines for patients or actual or potential harm to the interests of disadvantaged groups”. As long as the disagreement is maintained, the maximum industrial price that the product had when it was reimbursed remains in force (art. 93.5 of Royal Legislative Decree 1/2015).

- Non-prescription medicinal products.

They can be marketed at free price unless the Government regulates them “following a general objective and transparent regime” (art. 94.3 par 1 of the Royal Legislative Decree 1/2015) or unless the CIPM, when there is an exceptional health situation, and in order to protect public health, fixes the maximum retail price (“PVP”) for the duration of such exceptional situation (art. 94.3 par 2 of Royal Legislative Decree 1/2015).

PVL:

As discussed above, units of medicinal products for which a reimbursement/price ruling has already been issued by the DGCC and that are dispensed in Spain at the expense of the NHS [point (ii) above] cannot be commercialized at a price above the PVL set by the CIPM.

How is this PVL set?

As regards setting the price of medicinal products, Spain has always been said to follow a “cost plus” system, under which the maximum PVL should respond to the cost of the product plus a given profit margin. This is what Royal Decree 271/1990 contemplates in accordance with the provisions of Directive EC 89/105.

As a matter of practice, it has always been known that the price-approval process entails a negotiation with the authorities where the cost and the profit margin are not really the variables that are considered. Companies should be prepared for prices mainly to be determined by the following two issues: a) a comparative pharmaco-economic evaluation of the medicine in which the advantages of the new product should be quantified; or b) the price of the product in other EU Member States.

Other than these, companies must be ready for the authorities to consider other issues such as the activities performed by the company in Spain (R&D, manufacturing, etc.) and the relationship with a local company through a co-marketing or licensing arrangement.

2. How does price control at the wholesale level work in your country?

Please refer to the question above.

3. How does price control at the retail pharmacy level work in your country?

The margin of retail pharmacies (“Pharmacy Margin”) is regulated in art. 2 of Royal Decree 823/2008.

Pharmacy Margin is: (i) for those medicines whose PVL is equal to or less than €91.63, 27.9% of the retail price excluding taxes (“Retail Price”); (ii) for those medicines whose PVL is higher than € 91.63 and equal or lower than €200, €38.37 per package; (iii) for those medicines whose PVL is higher than €200 and equal or lower than €500, €43.37 per package; and (iv) for those medicinal products whose PVL is higher than €500, € 48.37 per package.

2. External Reference Pricing (ERP)

1. Is there a system of external reference pricing (ERP) in place in your country?

As per written Spanish law, the MOH is not allowed to reference prices internationally. International referencing was contemplated in the Law on Medicinal Products before 2012, but Royal Decree-Law 16/2012 of 20 of April revoked any reference to this practice in 2012 and from then on, international referencing has no legal basis in Spain. The Judgements of the Supreme Court of 28 October 2015 and 11 November 2015 confirmed this understanding.

With respect ERP, however, the theory substantially differs from the practice. While it is clear that the law does not allow the MOH to reference prices internationally, the truth is that ERP is, indeed, a quite relevant factor influencing price rulings in Spain (with respect both the PVL and the Notified Price). The fact that this practice has no legal basis, makes it quite difficult to identify how the MOH exactly factors in international prices and from which sources these prices are obtained. In any case, as per our experience dealing with the MOH, it has become clear that, on the one hand, the MOH requests the MAH to provide information about how the medicine has been priced in other EU countries; and, on the other hand, that EU prices operate as a cap for Spanish prices, meaning that prices in Spain are rarely fixed above the price of the same medicinal product in other EU countries.

2. When and/or how often is ERP activated?

Please refer to Q2.1 (Section IV) above.

3. What is the legal framework of the ERP in place in your country?

Please refer to Q2.1 (Section IV) above.

4. What is the composition of the country basket?

Please refer to Q2.1 (Section IV) above.

5. Describe the price calculation and selection for reference products.

Please refer to Q2.1 (Section IV) above.

6. How often does the price need to be updated?

Please refer to Q2.1 (Section IV) above.

7. How do the “price List”/catalogues from references countries work in your country?

Please refer to Q2.1 (Section IV) above.

3. Internal Reference Pricing (IRP) (Note, this is not applicable in some market, develop if is applicable to your country)

1. Is there an internal reference pricing (IRP) system in your country?

Yes. Once a generic or biosimilar version of a medicinal product is approved, or even if no generic or biosimilar exists in Spain but the main active ingredient of a product has been authorised in the EU for the last 10 years (and there exists at least one medicinal product different than the original product and its licences), the MOH may make such ATC5 substance subject to a reference price, which will apply to all reimbursed product presentations having the same ATC5 classification and identical administration route.

The reference price is the maximum price which the Spanish authorities will pay for these products. Such price is fixed on the value represented by the lowest cost of treatment per day of the presentations of the medicinal products included in each group.

2. What is the legal framework of the IRP in place in your country?

Spanish IPR is regulated in the Royal Legislative Decree 1/2015 and in the Royal Decree 177/2014 on the reference price system.

3. When and/or how often is IRP activated?

The MOH approves a reference price list every year based on the information in the database for reimbursed and marketed products (Nomenclator) as of April 1st. The list published by the MOH is called Reference Price Order (“RPO”). A draft of the RPO (to which companies may submit allegations) is usually published in Q2-Q3 of each year. The final RPO is usually published in Q3-Q4 of each year.

Also from this Market Access & Health Technology Assessment

5. HTA Decision Analysis Framework: Spain

1. Which are the health technology assessment (HTA) evaluation bodies and their responsibilities in your country?

The main bodies in charge of HTA in Spain are the AEMPS, the MOH (particularly the DGCC) and the regional governments; all of such bodies acting in coordination through REVALMED.[1] Also note that, as mentioned above, a recent Court Judgment (26 June 2023) annulled the documents that served as the basis for REVALMED and that, therefore, it is foreseeable that there will be important changes in this matter (including key players and bodies in charge of HTA in Spain) in the near future. For further details, see Q3 Section II above.

2. Do regulators require HTA studies in your country?

Regulators do no requite HTA studies for the application/obtention of MAs of medicinal products in Spain. To obtain a MA in Spain (following a national authorization procedure), medicinal products developers need to submit specific data on their medicinal product (dossier) that does not include HTA reports nor other type of studies comparing the assessed medicine with other medicinal products/therapies. The AEMPS then carries out a thorough assessment of such dossier to decide whether or not the particular medicinal product is safe, effective and of good quality and is therefore suitable for use in patients.

3. Do payers require HTA studies in your country?

Generally speaking, yes. Although it depends on the specific medicinal product or new indication assessed for P&R purposes.

According to Law 10/2013, TPRs have been interpreted as compulsory for pricing decisions, although the wording of Law 10/2013 is not entirely clear and may be interpreted otherwise.

The Plan to Consolidate TPRs (recently annulled by a the Spanish National High Court, as discussed above) also seemed to indicate that TPRs are compulsory for P&R purposes in the following cases: medicinal products and new indications authorized by the European Commission through a centralized procedure, new medicinal products authorized through a national procedure that contain new molecules, and all other medicinal products that the Permanent Commission of Pharmacy so considers considering its budget and sanitary impact.

In practice (and until now, this may change in the future due to the profound changes that the Judgment annulling the Plan to Consolidate TPRs may bring), TPRs have been mandatory for P&R Procedures in the cases outlined above. The DGCC (saved from very rare occasions) does not elevate a P&R dossier of new medicinal products/new indications to the CIPM until the TPR is ready and available.

4. How are HTA assessments translated into pricing conditions in your country?

In accordance with Royal Decree 271/1990 (still in force and fully applicable), Spanish authorities should follow a “cost plus” system under which the maximum PVL should respond to the cost of the product plus a given profit margin. Therefore, at least theoretically under Spanish written laws, HTA assessment should have no impact into pricing conditions.

However, as already discussed, the reality is different, and comparative pharmaco-economic assessments are often used to determine pricing conditions. In this respect, whenever a TPR has been approved, it heavily influences reimbursement and pricing decisions. How exactly the results of the TPR are factored in a pricing decision is hard to say, to the extent there is no legally mandatory guidance to be followed in this respect. In Spain, there are not mandatory cost-effectiveness thresholds either (although GENESIS’s guidelines[2] include some non-binding references). Be it is at may, we think is fair to say that whenever a TPR has been approved it is well taken into account by the authorities in charge of pricing decisions (DGCC/CIPM).

Finally, it is also relevant to note that Royal Legislative Decree 1/2015 (arts. 92.1.c and 92.8) contemplates that cost-effectiveness assessments may affect reimbursement decisions. Strictly, Royal Legislative Decree 1/2015 refers to “reimbursement” decisions (i.e., whether to reimburse or not) but not pricing ones (fixing the maximum ex-factory price in case a given product is reimbursed). Anyway, this reference, the fact that the reimbursement decision and the pricing decision overlap to certain extent (because the decision of the DGCC regarding reimbursement is also based on the price that the CIPM would set for the product), and the usual practice described in the preceding paragraph, allow us to conclude that HTA assessments have, indeed, a relevant impact in pricing conditions.

5. How are HTA assessments translated into reimbursement conditions in your country?

Please refer to Q4 (Section V) above.

6. Which are the evaluation criteria, processes or models and analyses framework used for HTA in your country?

There are no ex lege mandatory criteria, processes or models that must be followed in Spain to perform HTA assessments. Anyway, it is worth noting the existence of a standard operating procedure (SOP) to perform TPRs[3] approved by the Permanent Commission on Pharmacy of the CISNS and some guidelines developed by the GENESIS group[4]. Such documents, although not binding, have had a relevant impact on criteria, processes and models used in HTA assessments during the last years. The SOP, in any case, derives from the Plan to Consolidate TPRs which, as indicated above, has been declared null and void. This means that the legal validity of the SOP could also be questioned.

7. What is the methodology used in your country for HTA assessment?

There is no ex lege mandatory methodology that must be used in Spain for HTA assessments. The guidelines mentioned in the prior question (SOP to perform TPR[5] and GENESIS’s guidelines[6]) have also had some impact on the methodology used in Spanish HTA assessments over the last years.

8. Which are the other decisions impacted by the assessed outcome in your country?

The objective of the Spanish HTA assessments (included in the TPRs) is to provide a comparative therapeutic and economic evaluation of medicinal products in order to have relevant information, based on scientific evidence, on the position of the new product or its new indication compared to existing therapeutic alternatives, pharmacological or otherwise.

Such HTA assessments have an impact in several areas (apart from P&R decisions) including the selection, prescription and use of medicinal products. The Autonomous Communities and hospitals may also perform local HTA assessments, and such assessments may sometimes be influenced by the content of the TPRs (nationwide HTA assessment).

9. Does your HTA review or inquire other international HTAs during the assessment process? If so, which ones are the usual partners?

There is no list of international HTAs assessments that Spanish authorities must review before carrying out its own assessment. The SOP to perform TPR[7] and GENESIS’s guidelines[8] include some instructions on how to consider and assess the results of international evaluations, but do not refer to any specific international HTAs for that purpose.

Finally, it is relevant to mention that the DGCC almost always includes a section called “conclusions of other evaluation bodies” in the Associate Report for the CIPM (this is a report that includes the results of the TPR, some other therapeutic and economic evaluations, and a recommendation to the CIPM on whether or not to reimburse the medicinal product). In this section it is common to see references to evaluations made by NICE or French HTA evaluation bodies.

[1] As discussed, REVALMED has been recently questioned by a Court Judgement.

[2] Accessible at: https://gruposdetrabajo.sefh.es/genesis/genesis/Documents/GUIA_EE_IP_GENESIS-SEFH_19_01_2017.pdf

[3] Accessible at: https://www.sanidad.gob.es/profesionales/farmacia/IPT/home.htm

[4] Accessible at: https://gruposdetrabajo.sefh.es/genesis/genesis/Documents/GUIA_EE_IP_GENESIS-SEFH_19_01_2017.pdf

[5] Accessible at: https://www.sanidad.gob.es/profesionales/farmacia/IPT/home.htm

[6] Accessible at: https://gruposdetrabajo.sefh.es/genesis/genesis/Documents/GUIA_EE_IP_GENESIS-SEFH_19_01_2017.pdf

[7] Accessible at: https://www.sanidad.gob.es/profesionales/farmacia/IPT/home.htm

[8] Accessible at: https://gruposdetrabajo.sefh.es/genesis/genesis/Documents/GUIA_EE_IP_GENESIS-SEFH_19_01_2017.pdf